Financial Planning and Management¶

Economics - The Dismal Science in Support of Decision Making¶

Defining Alternatives¶

Application of economics principles to assign value to an alternative

Decision principles used to select the best alternative based on value

Physical consequences¶

Economic value – a basis for comparisons

Definitions/Concepts

Economic Analysis

Principles of engineering economics

Cash flows

Discounting methods

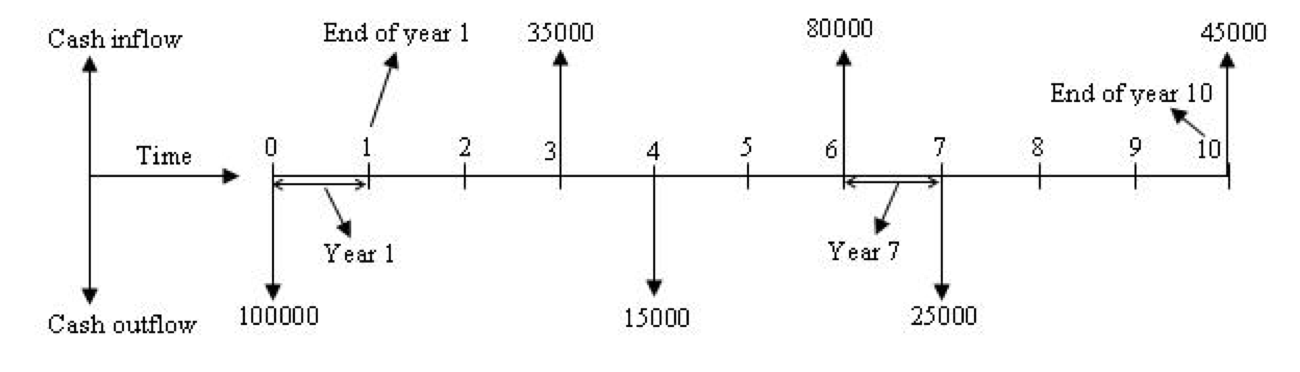

Cash Flow Diagrams¶

Graphic representation of cash outflow (costs) and inflow (revenue).

Convention is revenue (benefit) is plotted upward, and expenses (costs) is plotted downward.

All cash flows during a year are usually lumped into sums occurring at the end of the year

Discounting Factors¶

Discounting factor is a tool to convert a value at one date to an economically equivalent value at another date

All discounting problems can be expressed as combinations of two fundamental factors

Single-payment Compound-amount Factor

Single-payment Present-worth Factor

Present Value to Future Value¶

The factor computes the number of monetary units (FV) that will accumulate in N years for every initial unit (PV) invested at a rate of return of i-percent.

Future Value to Present Value¶

The factor computes the number of current monetary units (PV) that a future value (FV) is worth if the monetary units are invested at a rate of return of i-percent.

Other Factors¶

Notice the cash flow diagram looks the same – it is a tool to move values along the time axis. All other diagrams can be determined by combinations of these two concepts.

Can either apply algebra to make the combinations, or just use simple computer programming (e.g. R)

Example¶

Determine the present worth (PV) of a stream of annual payments, each payment is $100 for a period of 10 years. The discount rate is 3-percent per year.

Sketch a cash flow diagram

Discounting Techniques¶

Refers to systematic application of discounting factors to compare alternatives

The 4 accepted techniques are:

Present worth method

Rate-of-return method

Benefit-cost ratio method

Annual-cost method

Each method produces the same evaluation of relative value